www tax ny gov online star program

This State-financed exemption is authorized by Section 425 of the Real Property Tax Law. Were processing your request.

We changed the login link for Online Services.

. STAR exemption to register with the Tax Department in order to receive the exemption in 2014 and beyond Program applies to more than 26 million Basic STAR recipients Senior citizens receiving Enhanced STAR exemption are not impacted by this legislation All property owner questions should be directed to DTF at 518 457-2036 2. - scrolls down to website information. Your benefit may increase by as much as 2 each year.

If you are using a screen reading program. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Nys department of taxation finance rp-425e 2022-23 office of real property tax services application for school tax relief enhanced star exemption if you are not currently receiving the star exemption with the town of brookhaven do not file this form you must register with nys department of taxation finance.

If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. Basic STAR Exemption and Star ENHANCED Exemption. Enter the security code displayed below and then select Continue.

The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. The STAR program continues to provide much-needed property tax relief to New York States homeowners. The following security code is necessary to prevent unauthorized use of this web site.

Enhanced STAR is for homeowners 65 and older. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes.

Only available to homeowners who have been receiving the STAR exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill. Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions on your property before or you are a new homeowner of a property is required to register with New York State Department of Taxation and Finance. By submitting this application you grant your permission.

The Village of Freeport has no role in administering this program. New applicants who qualify for STAR will register with New York State instead of. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

Do it for free. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. STAR property tax relief program Whats New.

The benefit is estimated to be a 293 tax reduction. We recommend you replace any bookmarks to this. If you cant file on time request an automatic extension of time to file.

Enrollment in automatic income verification is mandatory. Refund assistance is not available after 430 pm. E-file directly to the IRS.

By paper Form IT-370 for individuals and Form IT-370-PF for fiduciaries. If you are using a screen reading program. The following security code is necessary to prevent unauthorized use of this web site.

Enter the security code displayed below and then select Continue. The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. There have been some changes in how certain homeowners will apply for STAR and in how they receive their STAR benefit.

The STAR credit program open to any eligible homeowner whose income is 500000 or lessyou receive a check in the mail from the Tax Department to. If youre a STAR recipient you receive the benefit in one of two ways. Beginning with the October 20192020 school tax bill the state will automatically switch current Basic STAR tax exemption participants with a household income greater than 250000 and less than or equal to 500000.

830 am 430 pm Monday Friday excluding holidays Main Number 518 279-7130. New York State personal and fiduciary income tax returns are due April 18. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. New York State recently altered the STAR program lowering the maximum income limit for the Basic STAR tax exemption to 250000. FreeTaxUSA FREE Tax Filing Online Return Preparation E-file Income Taxes.

Troy City Hall 433 River Street Suite 5001 Troy NY 12180 Hours. STAR Check Delivery Schedule. Basic STAR is for homeowners whose total household income is 500000 or less.

Receive your STAR check directly from New York State. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR. The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes.

Federal 0 State 1499. There are two types of STAR benefits depending on household income. Visit wwwtaxnygovonline and select Log in to access your account.

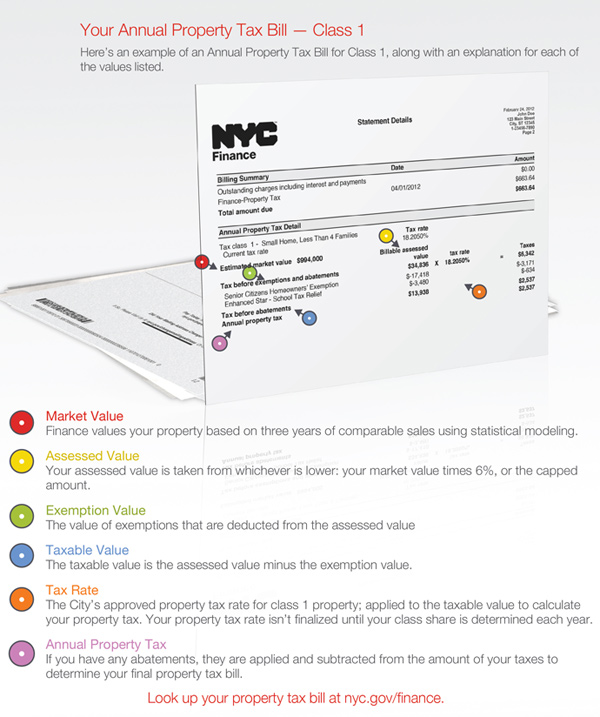

Nyc Residential Property Tax Guide For Class 1 Properties

The School Tax Relief Star Program Faq Ny State Senate

Solved In The State Of Ny There Is Supposed To Be A Tax Credit For Non Custodial Parents Who Pay Child Support And Are Current Where Does This Get Entered

New York Dmv Sample New York Dmv Photo Documents

Fill Free Fillable Forms For New York State

Receiver Of Taxes Town Of Oyster Bay